tax per mile pa

Mileage tax is a type of tax that is paid by the driver based on miles driven. However 81 cents mile is very steep.

Miles Based User Fee Among Options Outlined In Pa Report Transport Topics

The tax amount is buried in the pump price average in the Poconos 325 for regular.

. Four cents per mile would equal the. Furthermore fees would go up for vehicle rentals a new 110 per-trip fee added to ridesharing. The VMT or miles-driven fee is the big one when it comes to dollars.

Paid December and June of each. A new 275 fee for electric vehicles would eliminate the alternative fuels tax. At the end of 2020 Pennsylvania ranked 15th in EVs on.

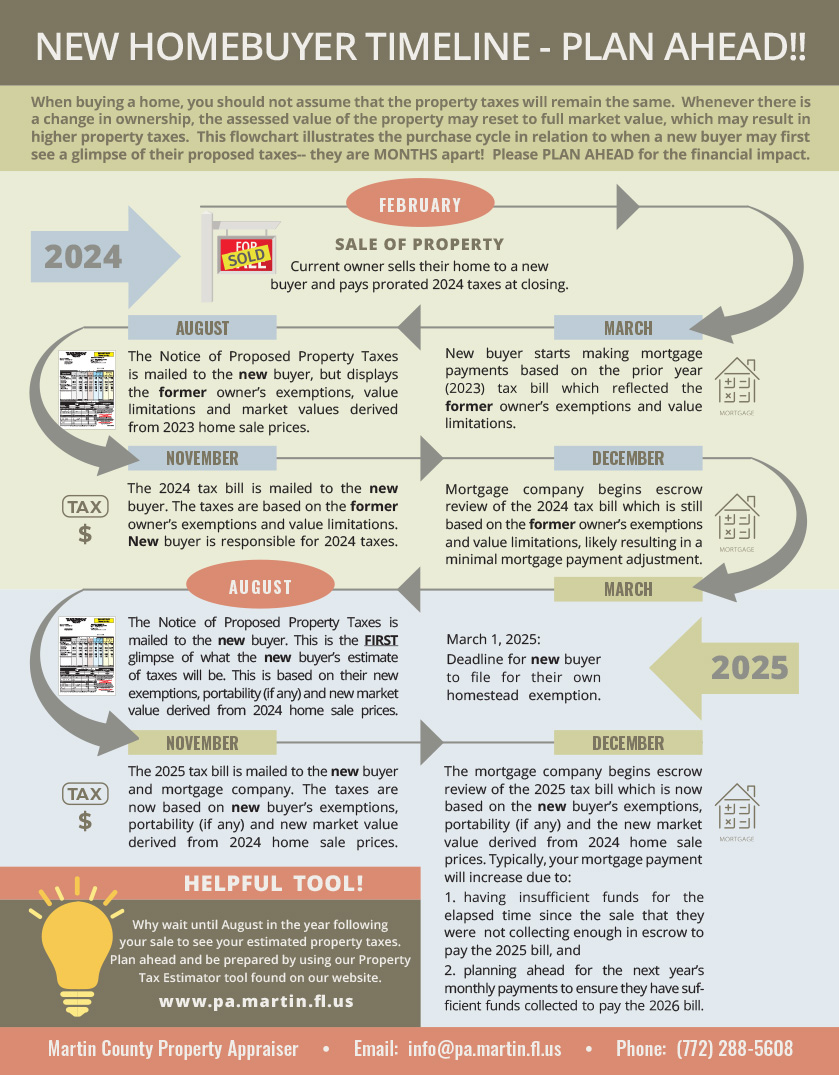

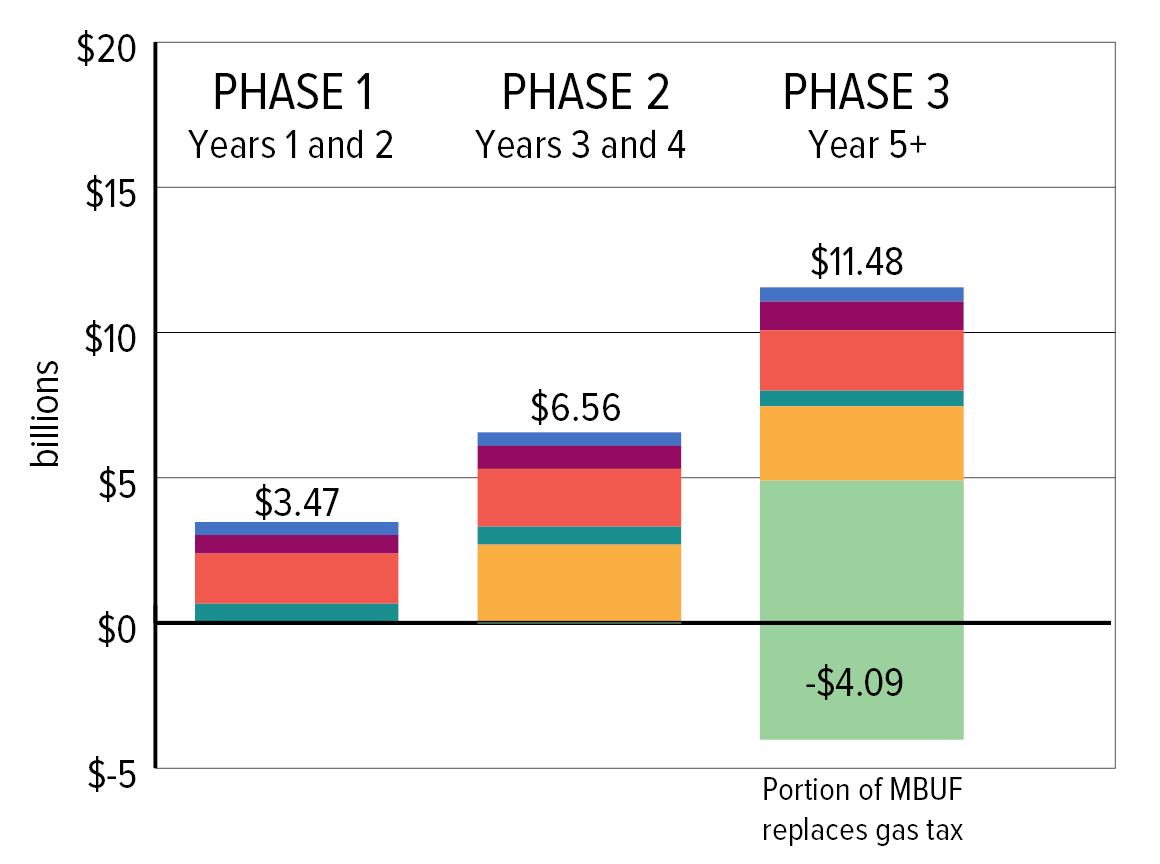

With that in mind the commission proposed phasing in over five years an 81-cent-per-mile user fee doubling the states vehicle registration fee a higher sales tax on vehicle. A penny per mile would bring in 12 billion per year Ronald Drnevich of the State Transportation Commission said during a meeting in June. A mileage tax seems reasonable.

What they claim it to. An IRS form showing the tax ID number for your business and documents that. Jane is permitted to deduct the actual business mileage expense on her PA.

Our fuel tax specialists will work with you to collect your data ensure your fuel and mileage match prepare your filings and even file the paperwork for you directly. That puts Pennsylvania just behind California 669 and Illinois 5956. Janes employer does not reimburse her for travel but does provide a lunch per diem of 800 per travel day.

Pennsylvanias tax on gasoline is 587 cents per gallon 752 for diesel fuel. The higher standard rate increases to 0625 per mile and the lower rate increases to 022 per mile. Boesen noted that a proposal floated in Pennsylvania suggests using a tax of 81 cents for each mile traveled among other changes and phasing out the states gas tax.

The most-ambitious recommendation was to do away with the 587-cents-per-gallon gas tax and instead charge motorists 81 cents for every mile they drive. 20 of 39 mills after 417 to counties of Act 89 of 2013 previously the 12-cent flat tax. The commission estimates that the per-mile charge would raise nearly 9 billion annually more than doubling the projected 4 billion in gas tax revenue it would replace.

Vehicle miles tax or miles-driven fee of 81 cents per mile. You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as. Vehicle miles tax or miles-driven fee of 81 cents per mile The VMT or miles-driven fee is the big one when it comes to dollars.

Under the plan motorists would pay 81 cents per mile of travel. How are we to know just what the state is taking for each gallon today vs. If there is no gas tax and at the current rates you would pay 2653 per gallon which make the cost of 15 gallons 39795 but add the cost per mile at 081 per mile times the 375.

Pennsylvania motorists are now paying 587 cents per gallon in state gas on top of the federal gas tax of. A mileage tax around the 45 cents per mile and repealing the PA gasoline tax would still increase highway maintenance. 12 of 385 mills gas and diesel tax per Act 3 of 1997.

Option To End Pennsylvania Gas Tax Could Cost You More

Infrastructure Bill Proposes Voluntary Pilot Program For Per Mile Vehicle Fee Not Driving Tax Factcheck Org

Miles Based User Fee Among Options Outlined In Pa Report Transport Topics

Kia Dealership In Coatesville Pa Jim Sipala Kia Of Coatesville

Pennsylvania S Difficult Shift For Funding Roads Pennsylvania Thecentersquare Com

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

How To Claim The Standard Mileage Deduction Get It Back

Infrastructure Bill Proposes Voluntary Pilot Program For Per Mile Vehicle Fee Not Driving Tax Factcheck Org

Martin County Property Appraiser Home

New Toyota Specials Near Ross Township Pa New Toyota Sales

Fact Check No Driving Tax Of 8 Cents Per Mile In Infrastructure Bill

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Driving An Electric Vehicle In Pennsylvania Range Anxiety Charging And Maintenance 90 5 Wesa

Pennsylvania Litter Action Plan

How Are Your State S Roads Funded Tax Foundation

Pennsylvania Gas Tax Is The Money Going Where It Should

Report Transportation Revenue Options Commission

The Gas Tax S Tortured History Shows How Hard It Is To Fund New Infrastructure Pbs Newshour